Leveraged buyouts LBO: Everything you need to know

In 2021, a group of financiers led by Blackstone Group announced a leveraged buyout of Medline that valued the medical equipment manufacturer at $34 billion. At the entry and exit multiples that match your transaction, do the returns shown in the table match what you got to in your model? Then, apply our equity inflows and outflows — our sponsor equity flowed out of our pocket when we entered the deal, and the exit equity was returned to us when we exited the investment. After all that work, now it’s time to see what our returns look like from this investment. This means we can lump our fee amortization all together into one line.

- Blackstone Group, the private equity firm, bought the Hilton brand and assets in 2007 just before the real estate crisis.

- A management buyout is focused on the person(s) or entity(s) completing the takeover, and a Leveraged Buyout is a method of financing for acquisitions.

- After you have all the years of the financial statements, the final step is calculate returns based on the financial projections and debt paydown that you’ve modeled.

- Crucial for the management team at the beginning of the process is the negotiation of the purchase price and the deal structure (including the envy ratio) and the selection of the financial sponsor.

The sponsor’s IRR will usually be tested for a range of values in a process called sensitivity analysis, which calculates different outcomes as assumptions and inputs change. The most common assumptions to change are the EV/EBITDA acquisition multiple, the EV/EBITDA exit multiple, and the amount of debt used. Knowing which phase your company is in can help you decide whether a leveraged buyout is the right option or if you need to postpone selling. If a company that was acquired in a secondary buyout gets sold to another financial sponsor, the resulting transaction is called a tertiary buyout. That’s a risky deal, mainly because the cost of the monthly loan payments, called debt service, on such a deal can be huge. Because of that, it can be difficult for some buyers to stay current.

Leveraged Buyout (LBO) Definition: How It Works, with Example

In a span of 4 years, the company made $50 million dollars not including performance fees that they are being paid by their clients. When a PE fund purchases a business, it either plans to hold the company and let it continue operating the same way or it may look to undergo operational improvements. This is all done in the hopes of either increasing the profitability of the business or expanding the multiple that the business is valued at. Given the amount of debt that will be strapped onto the business, it’s important that cash flows are predictable, with high margins and relatively low capital expenditures required. This steady cash flow is what enables the company to easily service its debt.

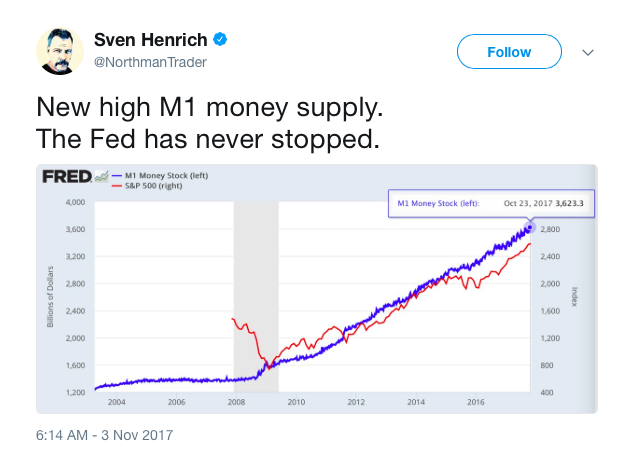

When Safeway was taken public in 1990 after many improvements, KKR earned almost $7.3 billion on their initial investment that totaled approximately $129 million. There probably are just as many successful MBOs as there are unsuccessful ones. Crucial for the management team at the beginning of the process is the negotiation of the purchase price and the deal structure (including the envy ratio) and the selection of the financial sponsor. Leveraged buyouts are often seen as a predatory business tactic because the target company has little control over approving the deal, and its own assets can be used as leverage against it. LBOs declined following 2008 financial crisis but have seen increased activity in recent years. A leveraged buyout (LBO) refers to the process of one company acquiring another using mostly borrowed funds to carry out the transaction.

EBITDA Multiples (comparable companies)

We’ll start with our net income, adjust for non-cash items in the income statement, and take into account our capital expenditures and change in networking capital (from the prior step). The ultimate goal of the model is to determine what the internal rate of return is for the sponsor (the private equity firm buying the business). Due to the high degree of leverage used in the transaction, the IRR to equity investors will be much higher than the return to debt investors.

Interest rates on the debt they are taking on are often high, and can result in a lower credit rating. If they’re unable to service the debt, the end result is bankruptcy. LBOs are especially risky for companies in highly competitive or volatile markets.

Sources

The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. An LBO is a type of acquisition where the acquiring company utilizes a high degree of debt to pay for the cost of acquisition. In doing so, the assets of the company being acquired are often pledged as collateral. Think of a Management Buyout as a way for employees to take control of the company in some form or fashion.

What are the 3 ways to create value LBO?

- Efficient Capital Structure. The primary way in which value is created in an LBO is through the use of borrowing to finance the acquisition.

- Operational Enhancements.

- Multiple Expansion.

- Combined Effect.

- What If Things Don't Go So Well?

The model will calculate both the levered and unlevered rates of return to assess how big the advantage of leverage is to the private equity firm. One of the keys to building an LBO model is making sure the credit metrics and debt covenants work for the deal. In the screenshot below, you will see how an analyst would model the credit metrics for this leveraged buyout. A leveraged buyout also allows groups such as employees or family members to acquire a company, if, for example, the current owner is retiring, which can also lead to greater engagement. Finally, if the target company is privately held, the seller could realize tax advantages from the LBO. Management buy-ins do not come with the stability that management buyouts are known for.

What Type of Companies Are Attractive for LBOs?

To be considered an LBO, the debt-to-equity ratio on an acquisition is typically between 70% to 30% to as much as 90% to 10%. That means the acquiring company invests 10-30% of the cost and borrows the remaining 70-90% to be able to make the purchase. Sometimes, the assets of the company being acquired are also used as collateral for the loans (rather than, or in addition to, assets of the company doing the acquiring). The final thing we can build in here is a couple sensitivity analyses to understand how our returns fluctuate based on our model assumptions. We’ll sensitize our entry and exit multiples, looking at impact to both MOIC and IRR.

Private Equity Outlook in 2023: Anatomy of a Slowdown – Bain & Company

Private Equity Outlook in 2023: Anatomy of a Slowdown.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

Calculating the IRR can be done using a dedicated spreadsheet program or a financial calculator and used for investment analysis. The goal of an LBO is to use as little equity as possible and repay as much debt as possible over a five to ten-year period to create a significant increase in the equity return. The rate of return can be as high as 20-30% with an LBO versus the 5-10% rate of return of just the business on its own. If a company is struggling because of industry recession or poor management, they could still be good candidates for a leveraged buyout if they have a positive cash flow. These circumstances may provide an opportunity to create efficiencies and improve the business and sell it for a high profit. Next, calculate the company’s cash flow available for debt service in years 1-5.

Add to Chrome

However, some companies grow so large and inefficient that it becomes more profitable for a buyer to use a leveraged buyout to break it up and sell it as a series of smaller companies. These individual sales are typically more than enough to pay off the loan of purchasing the company as a whole. If you have a company with different target markets for various lbo stands for products, this might be a good option. An LBO of this type can then give the smaller companies a better chance to grow and stand out than they would have had as part of an inefficient conglomerate. A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition.

- We first need to build the historical and projected income statements (P&L’s) through EBIT.

- In most LBO models a “cash sweep” is modelled in as mentioned before.

- The LBO analysis starts with building a financial model for the operating company on a standalone basis.

- Companies with stable and predictive cash flows, as well as substantial assets, generally represent attractive LBO candidates due to their ability to support larger quantities of debt.

- The acquiring company issues bonds against the combined assets of the two companies, meaning that the assets of the acquired company can actually be used as collateral against it.

What are the different types of LBO?

There are four main leveraged buyout scenarios: the repackaging plan, the split-up, the portfolio plan, and the savior plan. The repackaging plan involves buying a public company through leveraged loans, making it private, repackaging it, then selling its shares through an initial public offering (IPO).