What is Margin of Safety? MOS Formula + Calculator

In some cases, having a low margin of safety may be a risk you are willing to take. For example, the management team may see it as a temporary issue that will be resolved by future improvements. That means revenue from the sale of 375,000 units is enough to cover the entire production cost. On the other hand, if you’re in your 40’s, 50’s, or nearing retirement age, the margin of safety can be a great way to find safe, undervalued stocks for long-term holding. However, one thing is certain—the larger the margin of safety, the longer it will take to realize your profits. If you’re not in a rush, this is great—Warren Buffet, for example, looks to buy stocks at as much as a 50% discount if possible.

- Gross profit measures revenue earned after subtracting production-related costs, while net profit measures revenue earned after all costs have been deducted.

- A low margin of safety percentage causes a company to cut expenses whereas a high margin of safety percentage ensures that the company secures from the variability of sales.

- In fact, comparing growth investing and value investing is sort of like comparing apples to oranges.

- Profit measures a business’s earnings and margin of safety measures the sales required to turn a profit.

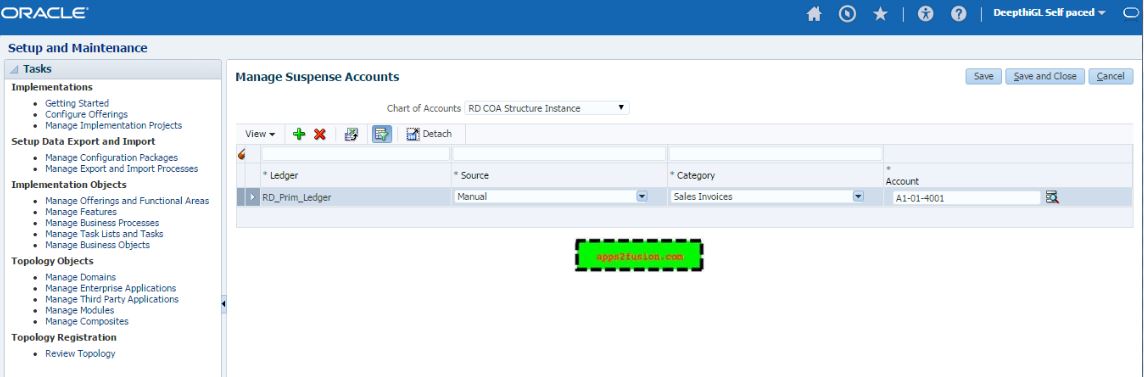

But the fact remains—this is a lens that can only be used to gauge the quality of a certain type of stock, so it is a bit inflexible and lacking overall. Right—now that we’ve dealt with the basics, let’s move on to something that’s a bit more practical. Although the margin of safety as a concept has fallen out of fashion as of late, it’s actually deeply tied to the origin of value investing as we know it today.

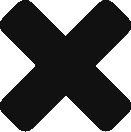

Alternatively, in accounting, the margin of safety, or safety margin, refers to the difference between actual sales and break-even sales. Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable. If the company has high fixed costs or is operating in a very competitive industry, this could be considered a relatively low margin of safety. Depending on the company’s inventory levels and projected future sales, this could be a good or bad thing. If the company has high inventory levels and low projected future sales, then this could be a cause for concern, especially if the company is already operating at a loss.

Margin of Safety: Examples, Meaning and FAQ

If the purchase price is higher than the intrinsic value, then there is a margin of risk. If your costs are largely variable, then a margin of safety percentage of 20%–25% may be acceptable. This is because you are probably more able to scale down costs in slow periods.

Initiation and duration of folic acid supplementation in preventing … – BMC Medicine

Initiation and duration of folic acid supplementation in preventing ….

Posted: Sun, 06 Aug 2023 23:35:27 GMT [source]

To estimate the margin of safety in percentage form, the following formula can be used. The Margin of Safety represents the downside risk protection afforded to an investor when the security is purchased significantly below its intrinsic value. In the case of cost-volume analysis, ( where MR and MC are constant), the break-even point is calculated with the help of Total Revenue and Total Costs. For example, with GoCardless, set up both recurring and one-off payments in advance. They are collected either as soon as possible or on your specified date. If you use GoCardless with a partner integration (e.g. Xero, Quickbooks or Sage), transactions are created, charged and reconciled automatically.

Complete Guide to Margin of Safety

Margin of safety is a very old concept—it’s a risk-management method hailing from the 1930s. It’s important to remember that the margin of safety you calculate for an investment is only as good as the intrinsic value calculation. If Netflix is destined to evolve into a no-growth company, a P/E of less than 18 may be realistic when you calculate its intrinsic value.

As previously mentioned, in investing, the margin of safety is the difference between the market value of a security and its intrinsic value. In accounting and sales, the margin of safety is the amount by which revenue exceeds the breakeven point. In other words, it is a measure of the amount of revenue that a company is generating above its costs. It is often margin of safety is equal to expressed as a percentage but it can also be expressed as dollars or standardized units. Operating leverage fluctuations result from changes in a company’s cost structure. While any change in either variable or fixed costs will change operating leverage, the fluctuations most often result from management’s decision to shift costs from one category to another.

Get Started with a Stock Broker

This vastly reduces issues with late payment and hence can vastly improve your cash flow. The margin of safety can also be represented as a percentage using the margin of safety formula. Margin of safety may also be expressed in terms of dollar amount or number of units. There are several factors that break-even point and margin of safety have in common. We’re well aware that this isn’t the most riveting of topics—both the formulas and calculations and the elusive concept of “intrinsic value” aren’t really stuff that will keep you glued to your screen.

- However, finding the true worth of security is subjective since each investor calculates the intrinsic value in a different way which can probably be accurate.

- If you focus on seasonal goods, keep an eye on this margin to guide you through off-peak sales periods.

- The break-even(base for margin of safety percentage) value depends on the type of business and is not generic.

- One of the caveats of the margin of safety is that it is, to put it plainly, a rather outdated and played-out approach.

Moreover, it enables the business to know whether they are below or over the break-even point. By going with the actual definition, the margin of safety in break-even analysis or MOS refers to the extent to which projected or actual sales exceeds break-even sales. It allows the people to find required outputs and work towards them. Using the same sales and breakeven point numbers from above and a price per unit of $50, the margin of safety would be 4 units. Our discussion of CVP analysis has focused on the sales necessary to break even or to reach a desired profit, but two other concepts are useful regarding our break-even sales.

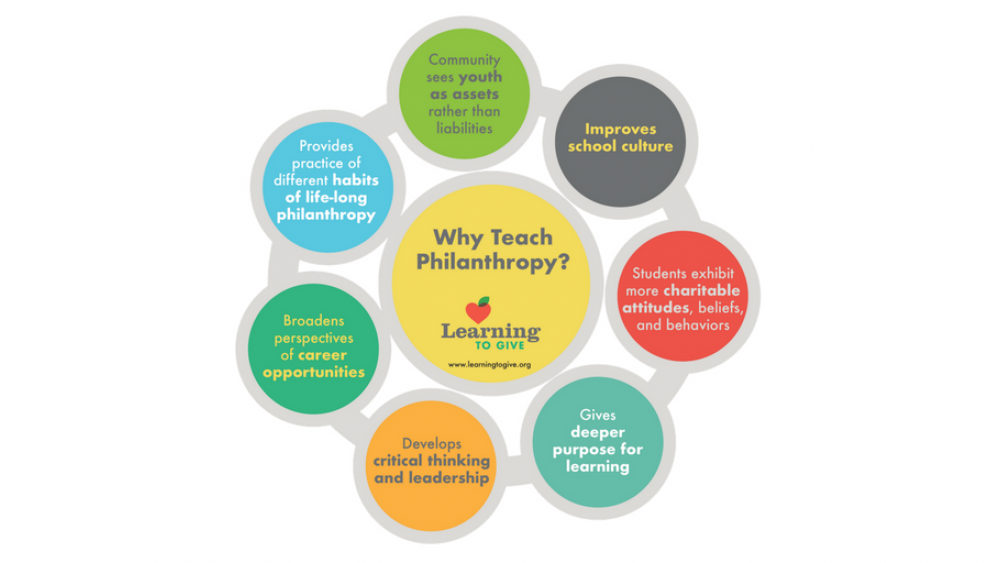

In the real world, the minimum margin of safety percentage to aim for generally depends on your cost structure. The margin of safety formula can be applied to different company departments or even to individual products or services. This gives an idea of how risk is spread throughout a single company.

Understanding margin of safety

To determine if you have a margin of safety, you need to figure out if that is doable. Forty percent per year for five years would turn earnings of $1 million into close to $5.4 million. The formula for calculating the MOS requires knowing the forecasted revenue and the break-even revenue for the company, which is the point at which revenue adequately covers all expenses. Generally, the majority of value investors will NOT invest in a security unless the MOS is calculated to be around ~20-30%.

Actual worth is the genuine worth of an organization’s asset or the current worth of an asset while including the total limited future income created. Let’s go back to Netflix to determine if it had a margin of safety following its stock price dive. Netflix’s current P/E is 18, but you believe the P/E ratio will increase to around the S&P 500 number of 24. Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when the market price of a security is significantly below your estimation of its intrinsic value, the difference is the margin of safety. Because investors may set a margin of safety in accordance with their own risk preferences, buying securities when this difference is present allows an investment to be made with minimal downside risk.

From a different viewpoint, the MOS is the total amount of revenue that could be lost by a company before it begins to lose money. If not, there is no “room for error” in the valuation of the shares, meaning that the share price would be lower than the intrinsic value following a minor decline in value. The applied loads have many factors, including factors of safety applied.

The wider your margin of safety is, the better chance that overly optimistic valuation inputs won’t doom your investment. By only investing if there is sufficient “room for error”, an investor’s downside is more protected. Therefore, the margin of safety is a “cushion” allowing for some degree of losses to be incurred without suffering any major implications on returns. The use of a factor of safety does not imply that an item, structure, or design is “safe”. Many quality assurance, engineering design, manufacturing, installation, and end-use factors may influence whether or not something is safe in any particular situation. Even after calculating all steps and measured steps, the investor can still fall if situations are under control.

The yield calculation will determine the safety factor until the part starts to deform plastically. The ultimate calculation will determine the safety factor until failure. On brittle materials these values are often so close as to be indistinguishable, so it is usually acceptable to only calculate the ultimate safety factor.

Because of its relatively modest returns, we recommend allocating a certain amount of your portfolio to value stocks picked using this method. But don’t go overboard with safety, or you won’t even be able to secure returns that are average for the stock market. Even by the standard of buy-and-hold investing, this particular brand of value investing might take years to play out. The common rule of thumb used for buy-and-hold investing of not touching your investments for five years at the least is far too lax when using the margin of safety. This, as we can see from how well his career went, worked marvelously—but conditions change, and as we’ll see later, this approach might not be as useful today as it was 90 years ago. Racquets sell for $4 per unit and have a unit variable cost of $2.60.