Finance vs Operating Leases: Whats the Difference?

Content

- Head to Head Comparison Between Capital Lease vs Operating Lease (Infographics)

- Key Differences Between Capital Lease vs Operating Lease

- IFRS Prescribed Accounting Rules for Leases (International Standards)

- How Software Can Help You With Lease Accounting

- Operating lease vs. financing lease (capital lease)

- How Commercial Solar Panel Depreciation Works

- How Does Equipment Leasing Work?

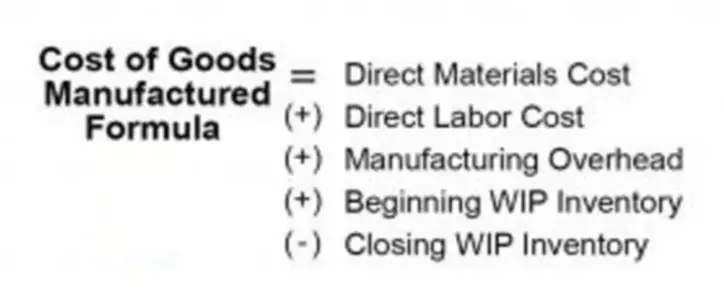

In all leases, the lessee acquires an asset, called a right of use (ROU), and a liability (the obligation to make lease payments). In other words, if there is transfer of ownership, then the lease will be qualified as a capital lease and treated as such for accounting purposes. A capital lease is a contract entitling a renter to the temporary use of an asset and has the economic characteristics https://www.bookstime.com/articles/capital-lease-vs-operating-lease of asset ownership for accounting purposes. With our interest expense forecast complete, the remaining step is to calculate the capital lease payment, which is captured on the cash flow statement. The notable difference between a capital lease and an operating lease is that for an operating lease, the asset must be returned to the owner at the end of the lease term.

What is the difference between operating lease and capital lease?

Leases have two classifications under US GAAP . A capital lease, now known as a finance lease, resembles a financed purchase; the lease term spans most of the asset's useful life. An operating lease resembles a rental agreement in that the asset is used for a set time with useful life remaining at lease end.

The party that gets the right to use the asset is called a lessee and the party that owns the asset but leases it to others is called the lessor. If you are a business or farm looking to understand more about leasing, here is what you need to know. There are two types of leases for solar energy – Capital Leases and Operating Leases. They function very differently and understanding your financial situation is important when choosing which one will work best for you.

Head to Head Comparison Between Capital Lease vs Operating Lease (Infographics)

The value of the leased asset is assumed to be the NPV of all lease payments committed in the lease agreement. The value of the leased asset is estimated from the lease disclosures in the company’s 10K statement. Pay special attention to the financial ratios to understand how capitalizing an operating lease on a company’s financial state impacted the company’s financial statements. We have shown below the impact of capitalizing an operating lease on a company’s financial statements. Note that the financial statements on the left side are statements before any adjustment is done. The financial statements on the right side are the financial statements after the operating lease capitalization adjustments are done.

However, there are a couple of important considerations; the lifespan and type of asset (in this case the fleet vehicle) as well as how it will be reflected in your company’s accounts. Operating leases used to not be documented on balance sheets, which is why U.S. firms often classified as many leases as possible as an operating lease. Leases allow organizations to “pay as they go” for the use of a needed asset without the burden of ownership and oftentimes with limited maintenance responsibilities.

Key Differences Between Capital Lease vs Operating Lease

However, it was not always the case that all types of leases were recorded on the lease balance sheet. Many companies used to prefer to classify their leases as operating leases precisely because they were only recorded on their income statement— they used to have no impact on a company’s balance sheet. The total lease expense booked under ASC 842 for operating leases is comprised of an asset lease expense and a liability lease expense and is equal to the total amount of required cash payments allocated evenly over the lease term. The liability lease expense represents the interest accrued on the lease liability each period and the asset lease expense represents the amortization of the lease asset.

- If the terms of the lease agreement meet any of the above-mentioned four criteria, the lease must be accounted for as a capital lease.

- In an operating lease, the lessee must maintain the property and return it or an equivalent at the end of the lease in as good a condition and value as when leased.

- Otherwise, it is an operating lease, which is similar to a landlord and renter contract.

- This is because most landlords likely factor in the future use for the asset when establishing the lease payments.

An operating lease is different in structure and accounting treatment from a capital lease. An operating lease is a contract that allows for the use of an asset but does not convey any ownership rights of the asset. Before concluding and deciding the type of lease, one must gain proper knowledge of the accounting and tax treatment done.

IFRS Prescribed Accounting Rules for Leases (International Standards)

We may be a little biased, but operating leases are always a sound financial decision. While the differences between operating leases vs. capital leases aren’t as significant under ASC 842, understanding each is still important to your decision-making process. As you learn more about your equipment leasing and financing options, you’ll want to understand some key structural differences between an operating lease and a capital lease. A company must also depreciate the leased asset that factors in its salvage value and useful life. When the leased asset is disposed of, the fixed asset is credited and the accumulated depreciation account is debited for the remaining balances.

All leases over 12 months are required through these new rules to be documented on the business balance sheet as both liabilities and assets. Because of this, operating leases under 12 months are treated as expenses and the longer-term leases are like purchasing an asset. As stated above, finance and capital leases are nearly the same in everything but name. Leases are classified as ‘finance’ when they have characteristics that make them similar to a purchase of the underlying asset. Finance leases then have imputed interest and are amortized over the life of the lease.

How Software Can Help You With Lease Accounting

To record a capital lease in your business accounting system, you must first determine whether the business owns the leased item. If the lease is classified as ownership, the item is recorded as an asset on the balance sheet at its original cost (called cost basis). The current and accumulated expenses for the lease are amortized, with part of the cost written off as an expense for the term of the lease. Make sure you include all the details of a capital lease to demonstrate the legitimacy of the lease.

- Operating leases used to not be documented on balance sheets, which is why U.S. firms often classified as many leases as possible as an operating lease.

- Thus, capital leases are accounted for essentially as purchases of equipment or other property.

- Since firms prefer to keep leases off the books, and sometimes prefer to defer expenses, there is a strong incentive on the part of firms to report all leases as operating leases.

- Thus, there are substantial effects on the balance sheet and income statement depending on whether a lease is classified as a capital lease or an operating lease.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. For the remainder of the lease term, the imputed interest expense will be calculated using the same methodology in order to determine the interest expense paid per year.

Operating lease vs. financing lease (capital lease)

The classification of a lease helps determine how the lessee recognizes expense. No change to expense is recognized when transitioning from ASC 840 to ASC 842; therefore, the income statement remains consistent. Operating leases will continue to recognize rent expense and capital/finance leases will recognize both interest expense and amortization expense. Furthermore, the present market value of the asset is included in the balance sheet under the assets side, and depreciation is charged on the income statement.

If an entity has a materiality threshold for fixed assets, a similar methodology may be applied to leases as well. Leases with a total term, including renewal options reasonably certain to be exercised, of 12 months or less are exempt from capitalization. Note that under ASC 842 this measurement is taken from lease commencement to lease end, not your transition date to lease end. This expense represents the lease cost and may differ slightly from the cash payment made each period.

Based on the company’s needs and the present tax scenario, decide on one or even a combination of both types of a lease for different assets of the company. The term should take into account any options to extend or terminate the agreement that are reasonably assured of being exercised. If less than 75% of the total life expectancy of the asset is covered by the lease term, then it is presumed that ownership transferral has taken place and the lease should be considered a finance lease.

Equipment leasing vs. financing – Yahoo Finance

Equipment leasing vs. financing.

Posted: Wed, 24 May 2023 07:00:00 GMT [source]

A capital lease is like ownership, the lessor books both an asset and a liability in the amount of the net present value of the lease payments. An operating lease on the other hand is like renting, no asset or liability is booked. In a capital lease both interest on the lease payments and depreciation of the leased asset may be recognized as expenses.

How Commercial Solar Panel Depreciation Works

Simply put, what this means is that operating lease payments are eligible for a tax deduction (because they’re considered operating expenses), while capital lease payments are not (because they’re considered debt). Despite these changes, operating leases are still considered a type of rental agreement, due to the lack of transfer https://www.bookstime.com/ of ownership, the expensed lease payments, and, in some situations, the short-term length of the lease. Historically, the payments you make towards the lease are accounted for as operating expenses and recorded on the income statement rather than the balance sheet, making operating leases a type of off-balance-sheet financing.